So a couple days back I went off to DFW Gun Range to get a little practice / exercise my Second Amendment rights / piss off the anti-gunners / all the above.

It was Handgun Day (not a holiday, although it damn well should be), because it was time I reminded myself which part of my handguns I need to press to make the boolet emerge from the naughty end. Here’s what I learned, from the three I took for an outing.

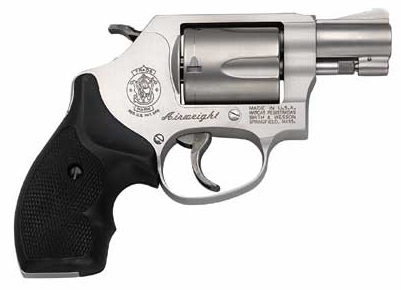

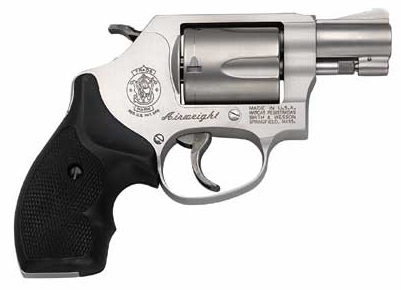

1) If I’m going to use the S&W 637 snubbie for self-defense, the distance between me and the thing I’m defending against should be no more than six inches further than arm’s length. Seriously: the combination of that lightweight frame, lengthy DA trigger pull, .38 Spec+P hollowpoints and teeny lil’ barrel does not lend itself to 1″ or even palm-sized groups in the target — at least, not if I’m trying to get off more than one shot per 5 seconds. That, or I need to start practicing weekly with the damn thing. I love the little gun: it’s light, compact and behaves like a fork — you pick it up, and it works — but it really is a backup gun.

2) Next came the old warhorse, the modified Springfield Mil-Spec 1911.

I blasted off over a hundred rounds of the lighter 185-grain .45 ACP (as opposed to the normal 230-grain stuff which has started to beat up my elderly wrists if I shoot more than a box at a time). Thankfully, the 185s are wonderfully accurate and target reacquisition is really quick. I practiced with El Cheapo (Monarch) JHP, which worked just fine; and when I switched to my hotter carry ammo (Hornady XTP, also 185-grain), my groups shrank still more. Now that, my friends, is a carry piece.

3) Finally, to cool off, I pulled out the newbie, my Ruger Mk IV 22/45 (reviewed here) because I’ve only fired a couple hundred rounds through the thing since I got it over a year ago, and I’m pretty sure that’s against some state law.

And then the problems started. I fired a couple-three mags without too much regard for bullet placement, just to get used to the Ruger’s trigger again — it’s better than earlier Ruger triggers, but not by much — and finally figured out where the sear would break in the pull. Fine. Time to get serious.

I should point out that for familiarization purposes, I was using Browning BPR .22 LR ammo, and when I did get serious, I started to get nervous: shooting offhand, I couldn’t get all the rounds into a 1″ circle at 7 yards. Indeed, no matter how hard I tried — and we’re talking five mags’ worth, 50 rounds), I’d get two inside the circle, then one low and left, then one back into the circle, then three low and left again, and so on.

Folks, I will readily admit that I’m not a good pistol shot; but I’m not that bad. I was just about to break out the old jeweler’s screwdriver and start screwing up adjusting the back sight, when I had a flash of insight. I asked the guy in the next lane if he would pop a mag downrange for me, just to see if it was the gun, or me. (He, by the way, was shooting a CZ 75B and putting all those 9mm Europellets into pretty much a palm-sized group, at 15 yards.) So he fired away with the Mk IV, and lo and behold, he too couldn’t shoot it for shit: either on target, or low and left.

Could it be the ammo? I pulled out my go-to .22 LR ammo (CCI Mini-Mag), loaded up and let two mags’ worth fly.

One-inch groups, dead inside in the circle. I switched to the Federal “Auto Match” (reviewed here) — a box of which had followed me to the range unnoticed: same result as the CCI Mini-Mags. [long sigh of relief followed]

So as far as the Mk IV is concerned, it’s going to be either Federal Auto Match or CCI Mini-Mag from now on. The Browning stuff will henceforth be relegated to tin-can plinking duties. (I don’t have much left, maybe 200 rounds, so it will go quickly.)

But: I’m still not crazy about the Mk IV’s trigger. Maybe I’m spoilt, having lately been shooting guns with excellent triggers, or maybe I just need a couple thousand rounds’ more practice to get used to it; but the Mk IV is on notice — which means that if I find a good deal / trade opportunity on a heavy-barrel Browning Buckmark (with its trademark exquisite trigger action) sometime, I may just go back to familiar territory, so to speak. The Browning is a bigger PITA to clean than the Mk IV, but them’s the breaks. Priorities, right?

I’ll keep y’all posted.