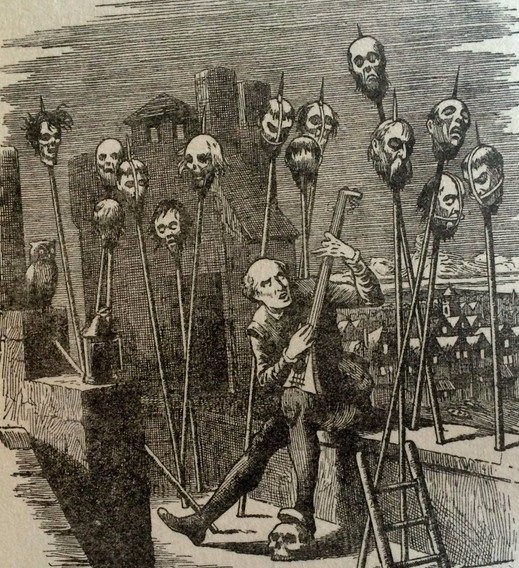

…and if you try to steal it, they will leave:

Millionaires are looking to flee the UK in their droves to escape Labour’s tax raids – with a record number of wealthy Britons tipped to leave the country this year.

Advisers to the UK’s richest households told yesterday how phones are ringing off the hook as their clients rush for the exit, as Chancellor Rachel Reeves plans to hike levies in its autumn Budget on October 30.

It follows PM Keir Starmer’s speech this week in which he painted a woeful picture of the state of the country’s economy, referring to financial ‘black holes’, as he braced the UK for a difficult Autumn budget.

The smart ones left long ago — some as much as a year before this new lot of Socialists came to power, I’m told — and most of the really smart ones made plans for this eventuality even earlier than that.

You see, not only are The Rich quite intelligent (trust fund babies and nobility aside), they also have access to all sorts of intelligence that others don’t. At Rich Fart #1’s afternoon cocktail party, for instance, one of the topics might be a sharing of information as to the best bolt-holes to flee to when the financial SHTF, along with the best methods to implement such flight. And Rich Farts #2-7 hand over details of which lawyers, tax experts, bankers and so on would be the best to facilitate said flights.

They’re so far ahead of the game, in other words, that they’ll be gone long before H.M. tax sharks send out the list of desirable legislation for the Socialists to pass. Hell, I bet that most have gone — or at least, their money’s gone — already.