Leaving aside the universally-loathed (by taxpayers) the tax on wages (misnamed the “income” tax), the most unpopular piece of governmental theft is that of the inheritance tax. And with good reason.

In the not-too-distant past, inheritance taxes were the only stream of tax revenue which actually cost more to collect than the revenue thus obtained. (In 2005, as I recall, the cost of collection per dollar was $1.07, and prior to that it went as high as $1.13, before the IRS — with the willing aid of Congress — “improved” their tax collection ratio simply by disallowing many of the cutouts and exceptions.)

But what’s interesting about these taxes is that they were hated even by Americans who would never pay a dime after their parents passed away — the implicit unfairness of the tax’s rationale that the inheritor never “earned” that inheritance, and therefore it was “unfair” and should be redistributed confiscated by the State, was understood by everyone to be total bullshit (born of pure Socialist wealth envy).

Now try this little piece of bastardy, courtesy of President Braindead’s handlers:

Democrats in Congress have made no secret of their desire to slip all sorts of tax hikes into the various massive legislative packages that have thus far (thankfully) remained bogged down in the Senate. They would like to see a significant increase in the gas tax to pay for the liberal wish list known as “infrastructure.” There’s also a continued push for a so-called “wealth tax” on people who are considered by the Dems’ socialist wing to have “too much money.” But one of the most controversial of these plans is the call to greatly expand the inheritance tax, more correctly known as the death tax. However, describing it as either an expansion or an increase isn’t accurate. The New York Post took a look at the plan this week and revealed that what they really want to do is create an entirely new category of taxation for the estates of the deceased, treating the transfer of assets to survivors as a capital gains event.

And it gets better:

For those of you who are thinking that this is “somebody else’s problem” because it only applies to the rich and famous, think again. If you’ve ever read Thomas Stanley’s 2010 bestseller, “The Millionaire Next Door,” you probably understand how this works. If you work throughout most of your life, put money away into any sort of retirement plans, and own your own home, you can break the millionaire barrier without too much trouble by the time you are in your sixties. No, not everyone in the middle class manages it, but this applies to a lot more people than you might think.

If you are fortunate enough to live for a very long time after you retire, you may burn through a fair bit of that wealth. But if you unfortunately only make it to somewhere around the national American average life expectancy, in your mid-70s or even late-60s, you could still be sitting on a tidy sum to help your family along. But nearly 80% of that wealth would evaporate under Biden’s new scheme.

And to reiterate:

Good luck figuring out the arguments in favor of a system of governmental robbery like this. Aside from envy and a desire to eat the rich or “redistribute” everything, there aren’t many. But one of the most compelling arguments against this capital gains concept is that we would be treating wealth held in individual estates the same as income. And all of that money and value has already been taxed. Every estate tax represents a case of double taxation on the same income via renaming the fingers coming to pick your pockets. Don’t let them get away with it. Estate taxes should be repealed, not effectively doubled.

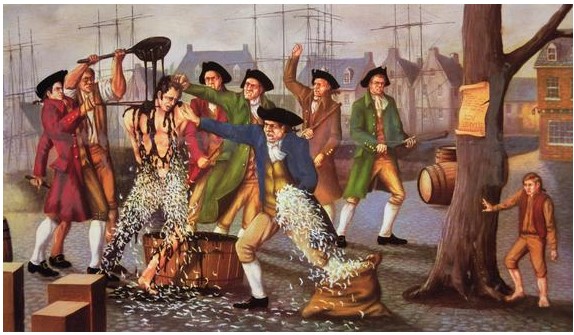

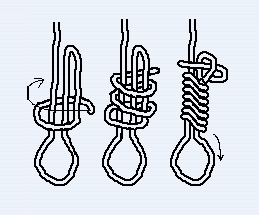

This would be my suggestion to stop them getting away with this new kind of theft, but no doubt someone will have a problem with it.