Your suggestions in Comments.

Your suggestions in Comments.

We interrupt today’s regular programming to bring you this news:

Nine years ago today, Michael Brown was shot and killed by a police officer in Ferguson, MO.

The actual back story:

Brown was a criminal who strong-armed a local mini-mart then sucker-punched Officer Wilson, who was seated in his patrol car, and reached to steal Wilson’s service pistol, leading to the first shot. When Wilson exited the vehicle Brown made a second charge at Wilson, and who fired the fatal shot.

Just so we’re all clear on the facts of the matter.

Seen in some newspaper article or other Somewhere On Teh Intarwebz (SOTI):

![]()

…a.k.a. the “You Don’t Say!” department.

That said, I once made a used-car salesman so angry that he challenged me to a fight outside the showroom. Connie just looked at him, then looked at me and said: “Just don’t kill him, okay?”

Challenge was withdrawn.

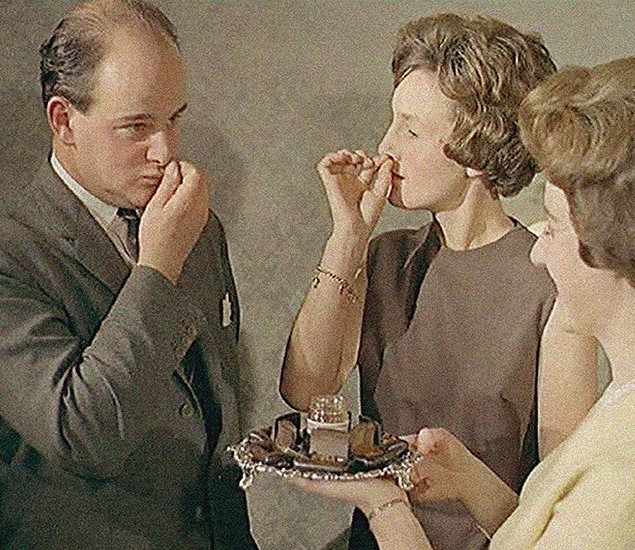

If ever you utter the words “election fraud” and are met with eyerolls, looks of pity and so on, feel free to repeat the content of this excellent historical infographic on the topic from Doug Ross. A sample:

And all those points are amplified, one by one.

Better still, the actions described are not only irrefutable — if anyone even attempts to refute them, their motives are to be questioned — they are all documented fact.

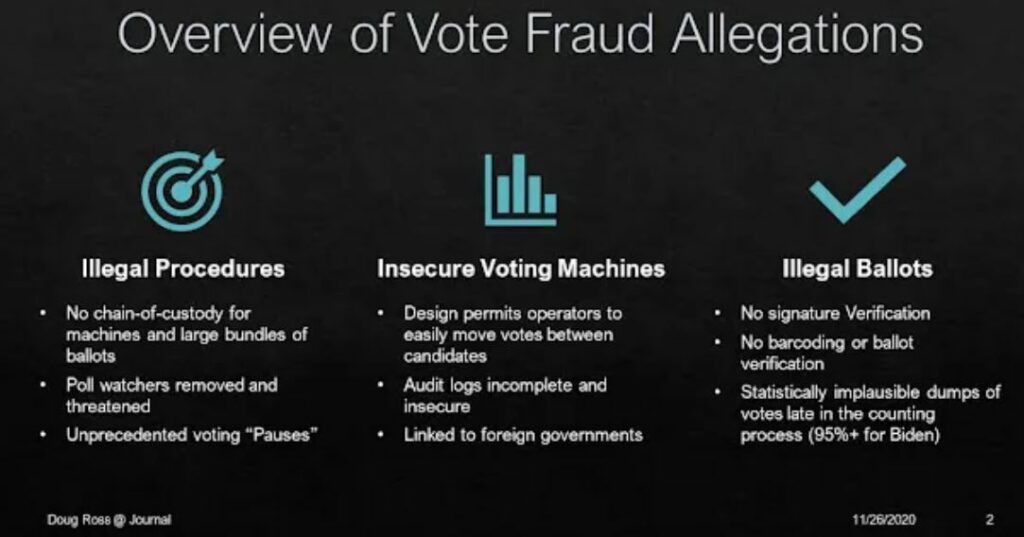

Apparently, Keef’s old Dino is on the market:

There’s no way I’d ever pay over $400 grand for a Dino — even if it is the car of my dreams — and especially not if it’s been home to Keef’s hairy ass. (Because you just know he drove it whilst naked, at least once.)

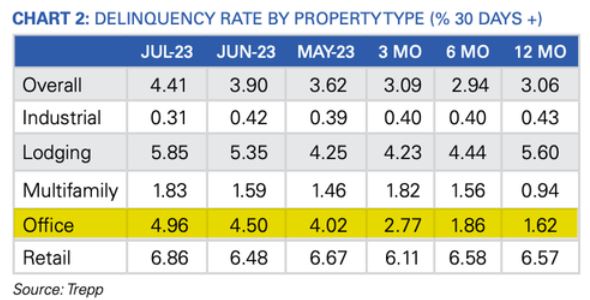

In reading an otherwise-interesting article about the looming collapse in commercial real estate, I hit a speed bump at top speed:

Yes, yes, yes I know that it’s the accepted accountancy practice to put the most recent number at the left of a chart, but it simply supports my thesis that non-grammarians (e.g. cops and accountants) should never be allowed to dictate literacy practices.

To wit: we go from A to B, from top to bottom, from bad to worse and similar fashion in any number of reading customs and idioms… because in the Western alphabet — in which this article was written — we read from left to right (and not to right from left). We are not Japanese, or Arabs, or Israelis, who are perfectly free to read diagonally across a page if they so wish, using their chicken-scratch pictograms, hieroglyphs or alphabets, but the language of commerce and industry is English.

Except when it comes to accountants.

So when I read the above chart — and I must remind Readers that reading charts was my métier for well over three decades — I couldn’t see what the fuss was about, until I realized that the fucking thing was written backwards.

I never understood nor cared for this accounting practice, which in non-accounting trend data makes the very next chart in the article perfectly comprehensible:

…simply by virtue of the fact that it follows the accepted timeline format whereby the first data point falls to the left, and the latest data point falls to the right of the trend.

Why accountants have to be different simply beats me.

Once I got past that, the article was extremely interesting:

One major hurdle for CRE (Commercial Real Estate — Kim) space is that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note to clients. Shalett expects a “peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.”

But, says BoA, we don’t have to worry:

Bank of America analysts expect challenges in the CRE space but noted, “They are manageable and do not represent a systemic risk to the US economy.”

…unless, of course, you’re a small bank, whose CRE investment exposure (from memory, anywhere from 10-15% of total assets) is typically much higher than that of GlobalMegaBankCorp (5% or less).

…unless, of course, you’re a small bank, whose CRE investment exposure (from memory, anywhere from 10-15% of total assets) is typically much higher than that of GlobalMegaBankCorp (5% or less).

Fun times we live in, what? And not helped by stupid grammar.