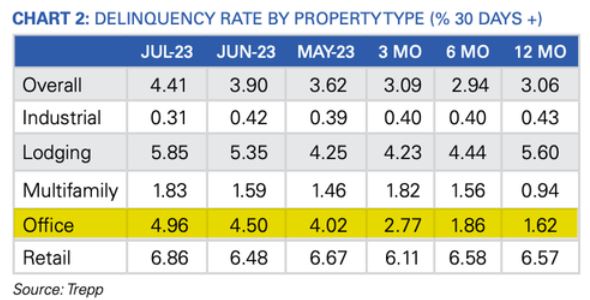

In reading an otherwise-interesting article about the looming collapse in commercial real estate, I hit a speed bump at top speed:

Yes, yes, yes I know that it’s the accepted accountancy practice to put the most recent number at the left of a chart, but it simply supports my thesis that non-grammarians (e.g. cops and accountants) should never be allowed to dictate literacy practices.

To wit: we go from A to B, from top to bottom, from bad to worse and similar fashion in any number of reading customs and idioms… because in the Western alphabet — in which this article was written — we read from left to right (and not to right from left). We are not Japanese, or Arabs, or Israelis, who are perfectly free to read diagonally across a page if they so wish, using their chicken-scratch pictograms, hieroglyphs or alphabets, but the language of commerce and industry is English.

Except when it comes to accountants.

So when I read the above chart — and I must remind Readers that reading charts was my métier for well over three decades — I couldn’t see what the fuss was about, until I realized that the fucking thing was written backwards.

I never understood nor cared for this accounting practice, which in non-accounting trend data makes the very next chart in the article perfectly comprehensible:

…simply by virtue of the fact that it follows the accepted timeline format whereby the first data point falls to the left, and the latest data point falls to the right of the trend.

Why accountants have to be different simply beats me.

Once I got past that, the article was extremely interesting:

One major hurdle for CRE (Commercial Real Estate — Kim) space is that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note to clients. Shalett expects a “peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.”

But, says BoA, we don’t have to worry:

Bank of America analysts expect challenges in the CRE space but noted, “They are manageable and do not represent a systemic risk to the US economy.”

…unless, of course, you’re a small bank, whose CRE investment exposure (from memory, anywhere from 10-15% of total assets) is typically much higher than that of GlobalMegaBankCorp (5% or less).

…unless, of course, you’re a small bank, whose CRE investment exposure (from memory, anywhere from 10-15% of total assets) is typically much higher than that of GlobalMegaBankCorp (5% or less).

Fun times we live in, what? And not helped by stupid grammar.

Turning office buildings into apartment complexes.

I expect commercial architecture redux to increase in the coming years.

My least favorite form of work.

re: backwards charting. At our manufacturing facility, we do online lab analysis the same backwards way, with a twist. The most recent data is on the very left side. The next 3 columns are the previous results, but back to normal rotation. i.e. columns from left to right, newest data, fourth oldest, third oldest, second oldest data. I have to read it 2 or 3 times every time I check to make sure of what I’m looking at. Of course, devised by lab chemists, most if not all (I’m assuming) are heavily medicated on their own homebrew juice. Based on my experience.

A friend has been working from home since before the pandemic idiocy. The company has always had that job as remote work….since the 90s at least. They now want all remotr people to report to offices. The office she would go to is in Baltimore in a bad part of town….yes there are good parts….but the company is slow to implement this as they do not have enough office space. They are not giv8ng pay increases for beating on car nor offering mileage….its more than 35 miles. So she is waiting but quietly checking closer jobs or other remote possibilities.

It is just stupid.

Has the bottom fallen out of commercial real estate yet? I see more commercial real estate being built and sitting idle in my area while existing store fronts remain vacant. There are several office buildings around too that sit idle. I think more will follow if this work from home trend continues. This will have a huge effect on the economy with office furniture, supplies, housing design and furniture etc

JQ

I’ve seen this before, gas pumps for instance ! 3 buttons to select

octane rating. One might think that the lowest rating ( cheapest ) would be

on the left with next highest rating/price in the middle and ‘premium’ on the

right but no. They are exactly BACKWARDS ! So if you don’t pay attention

you get the expensive stuff instead of the watered down stuff.

Now someone convince me that this is accidental ! Go ahead, try.

This has been going on in various places / professions for a long time.

Remember when you simply could NOT read a hand written prescription.

They were supposedly written in latin but I still wondered how the hell does

the pharmacist read them, let alone TRANSLATE them ??

Is the button placement on gas-pumps a regional problem, or is it just confined to one or two major chains?

Here in the NV outback, and even in LV, the lowest octane (price) fuel seems to always be the LH button. Of course, here, a lot of pumps only have two choices: 87-octane, and #2 diesel.