“Well Kim,” you may ask, “how was your trip to the tax guy yesterday?”

About the same as your dog getting its temperature taken for the first time:

What I love most about the tax code for retirees is that no matter how large the “contributions” you paid into SocSec, you don’t get enough to live on when you do finally retire; then as a retiree, when you earn a little extra money trying to make ends meet, your SocSec income is taxed.

So how do I really feel?

I’m putting together my tax stuff presently. I have no idea what to expect. Started a new job and withheld like a single guy with no dependents. Inherited part of an IRA from an uncle and transferred it out to a different fund, sold some stock…

It’s a crap-shoot this year.

I’ve been taking my SS benefits for a few years but still have my full time job. As a result, I’m still paying into SS and Medicare but the thing that really puts a burr under my saddle is sending two of the twelve SS payments to the IRS every April.

People in your situation (and we are legion) pay a higher tax rate than Warren Buffett’s Secretary, when he thought it was terrible that he wouldn’t pay more in taxes voluntarily than she had to pay under threat of force of law.

I did my UK tax a week ago. I expect it’s just as painful.

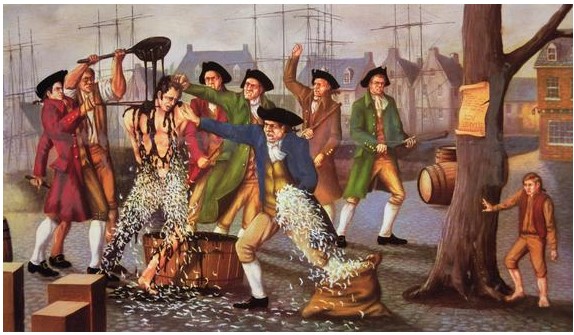

we should have elections the day or week after we pay taxes so we can vote out the scoundrels that set the tax rates.

JQ

Reminds me of the time I filed for unemployment benefits. They payed me too much and I thought it was what I was supposed to get….yadda yadda yadda I got squat until I repaid the overpayment.

Lesson learned. Dont depend on the bureaucracy. They will $$$$$ you and not care.

The tax code is thousands of pages long so that no one can understand it. I just looked at the IRS site, and it gives outdated information in addition to contradictory advice. I am trying to figure out a form and am still not sure what they want, nor do I fully understand the questions. Taxation is power and the powers that be will only increase that power as time goes by.

I share Mr. Kephart’s situation in that I am still working full time yet getting taxed as additional income my long promised social security benefit, while still putting money in. I have money withheld from social security to offset the bite at tax time, I wonder if it will be enough.

Do work that pays “off the books”.

I know someone that collects SS and made $27k this past year that way.

It’s not wrong to thwart a thief, in fact, it’s commendable.

Kim;

Don’t get me started on Social Security. I found this somewhere on the net back in @2015. Kudos to the unknown originator (not me) – it explains SS in a nutshell:

Social Security

“Not only did we all contribute to Social Security but our employers did too. It totaled 15% of our income before taxes. If you averaged $30K per year over your working life, that’s close to $180,000 invested in Social Security. If you calculate the future value of your monthly investment in social security ($375/month, including both you and your employers contributions) at a meager 1% interest rate compounded monthly, after 40 years of working you’d have more than $1.3+ million dollars saved! This is your personal investment. Upon retirement, if you took out only 3% per year, you’d receive $39,318 per year, or $3,277 per month. That’s almost three times more than today’s average Social Security benefit of $1,230 per month, according to the Social Security.”

Definitely gets your attention.