Here’s a fresh take:

“To love.”

“To pain.”

“Tonight.”

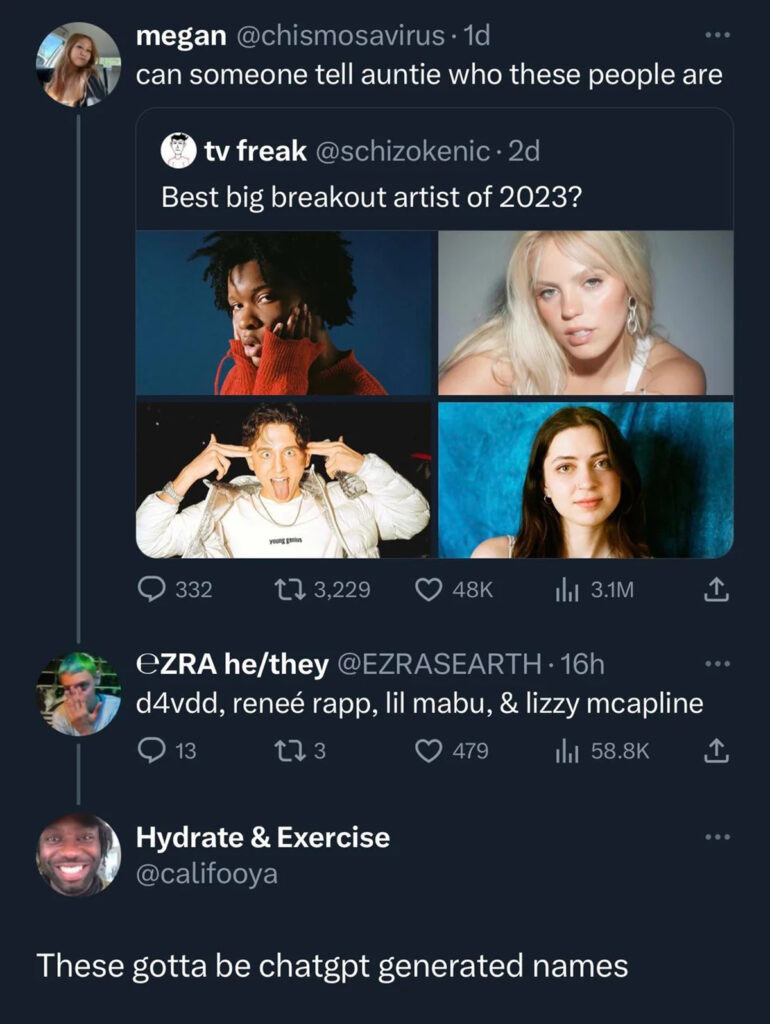

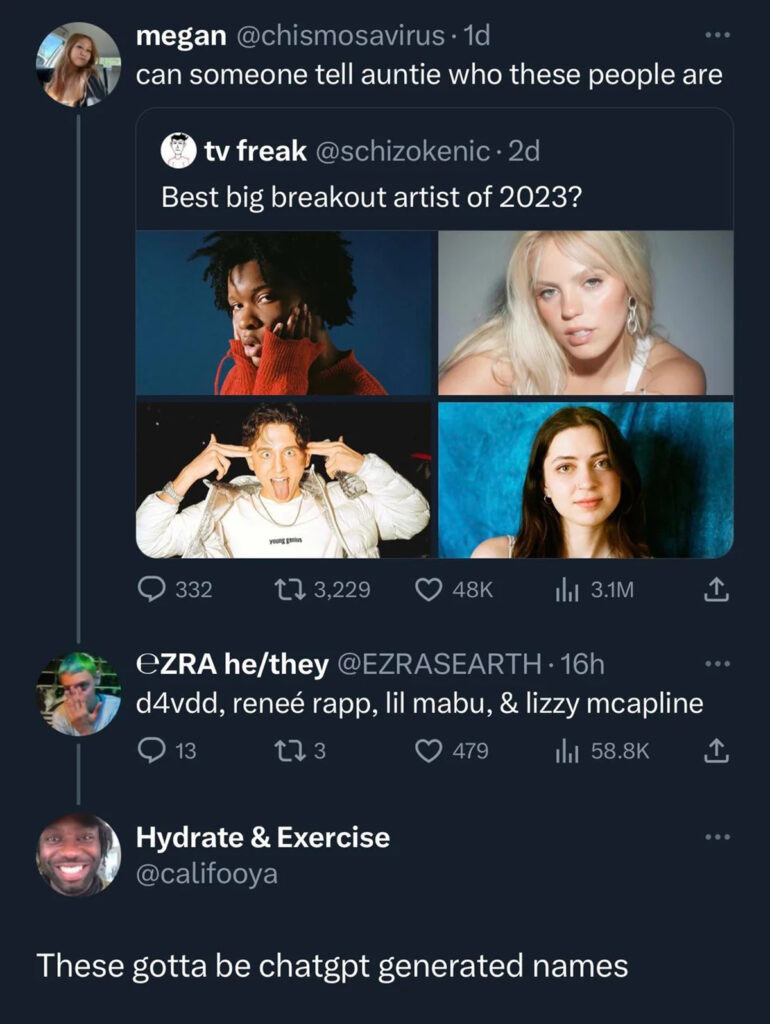

And our “exit” music for the day, played by:

Extra points if you can identify any of them.

Here’s a fresh take:

“To love.”

“To pain.”

“Tonight.”

And our “exit” music for the day, played by:

Extra points if you can identify any of them.

Comments are closed.

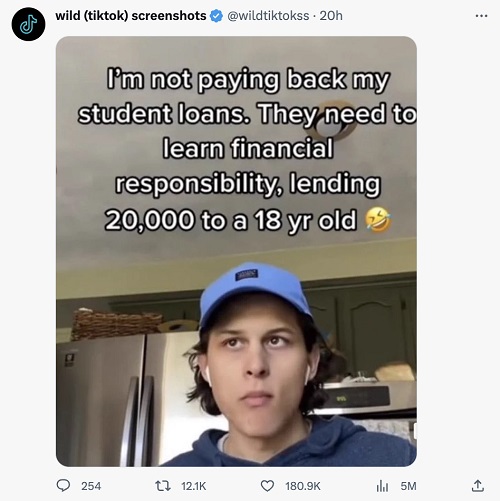

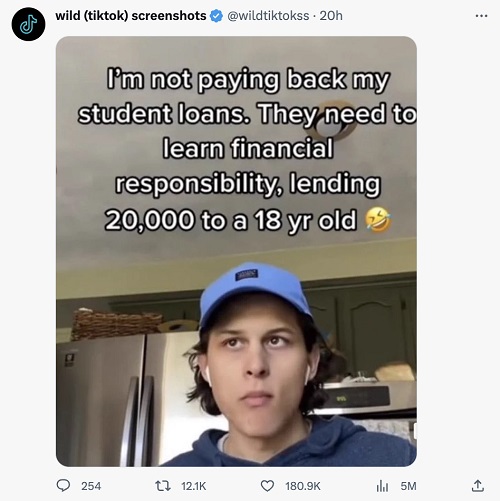

The student loan thing amazes me.

2 scenarios

1 – 18 year old with either a minimum wage job or no job goes to a financial institution and asks for a loan on an expensive vehicle. It’s only $ 100,000 they say and I have my whole life and career ahead of me. I’ll make payments after 4 years on it until it’s paid, even if it takes me a lifetime. Financial institution says fuck to the no.

2 -18 year old with either a minimum wage job or no job goes to a financial institution and asks for a loan on an expensive communist indoctrination center reprogramming. It’s only $ 100,000 they say and I have my whole life and career ahead of me. I’ll make payments after 4 years on it until it’s paid, even if it takes me a lifetime. Financial institution says absolutely and the loan is backed by the govt aka the US taxpayer. We will even defer payment during a SCAM-demic and maybe even “cancel” your loan later if you don’t feel like paying. The taxpayers can foot the bill for your lazy ass. Sign here please. You are approved.

Scenario 1 is correct. Scenario 2 is lunacy.

The nasty side of me says, fuck the student loan industry.

Yeah, I know, it’ll get passed onto me but, take a look at the debt clock – https://www.usdebtclock.org/ – I’m already half a million in debt for stuff I didn’t do, so what’s another half a mil?

Scenario 3: 18 year old who’s just been hired as an auto mechanic goes to bank and asks for a $10k loan to buy tools for his new job. Tells bank “I’ve got a job that pays $50/hr, on the condition that I provide my own tools.” Bank says no.

Back when banks made loans like that, it was because the government guaranteed the bank would be repaid if the kid didn’t pay off the loan, or even missed a few payments. It was zero risk for the bank. The government could be out the money, and the kid might owe for the rest of his life, without even being able to get out from under it in bankruptcy, but why would the banker or the college care? They always got their money.

But that changed back in the Obama administration. Guaranteed loans are gone, replaced by government loans. There’s no bank involved anymore. Now, the college fills out loan papers for the kid, and they are approved by a government official, and neither the college official nor the government official give a d%$&. Their own money is not at stake, nor the college’s money.

Um… Candy Dulfer? Florence Henderson? And I had a 40-year career in the music biz.

Candy, yes, Florence, no.

No idea who any of the lovely and talented ladies are. Kind of surprised you didn’t include Suzanna Hoffs, who w ould also fit into your Fabulous Fiftes theme posts (except I think she might be over 60)

Forget Barbie and Ken, I’ve read that in the seventies there was a T shirt that read, “Forget Romeo and Juliet, give me a love like Gomez and Morticia.”

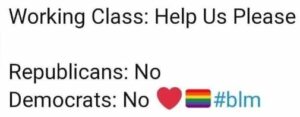

Student loans like most things should be within the realm of private industry. Take out a loan to follow a STEM career, then the return on investment is most likely to be there. The Return on investment for an art degree, any studies degree etc simply is not there so the amount allowed to borrow should be very low with a very high interest rate. Let the market run this properly and many students simply be denied going into debt because the banks wouldn’t risk the default on the loans.

JQ